The government is seeking ways to develop non-commodity exports and the petrochemical industry seems a sure bet. Businesses keep announcing new investment projects but can proceed with only one in ten. The key risk is capital intensity of construction and consequently low return on investment. What stimulation mechanisms does the industry need, and are there really no instruments to support petrochemical projects in Russia?

At the core of the petrochemical industry are the facilities with steam crackers. In Russia, there are ten of them, with the combined ethylene capacity of 3.1 mt.

Ethane cracking produces high yield of ethylene but its recovery requires additional investment in deep conversion, and the transportation issues chain ethane chemical facilities to gas fields.

Foundation

All operational crackers were built back in the second half of the 20th century. The latest facility launched was Tomskneftekhim in 1981. Thus, there has not been a single major petrochemical plant commissioned in Russia in the recent 35 years. Limited number of the facilities means they are running at high operating rates – over 85%, on average. In case of emergencies or unscheduled downtime, the market may run up a deficit. For instance, the accident at Stavrolen in February 2014 cut the polymer supply to the domestic market by 0.3 mt (ca. 6–7% of the total consumption), which had to be urgently replaced with imports.

Russian petrochemical feedstock consumption consists mostly of straight-run petrol (naphtha) and LPG, with a much smaller share of natural gas liquids (NGL) and ethane. Naphtha comes primarily from refineries that can fully meet the needs of large-scale steam crackers. For that reason, naphtha-based petrochemical facilities are often integrated into refineries. That is the case of Angarsk Polymer Plant, Nizhnekamskneftekhim and Gazprom NeftekhimSalavat, to take a few. In 2017, petrochemical naphtha consumption amounted to 4.8 mt.

LPG for cracking is primarily consumed by SIBUR-Kstovo, Kazanorgsintez and Ufaorgsintez, with ca. 1 mt of the combined processing volume in 2017 and 4.7 mt of LPG consumption for petrochemicals (including for propane dehydrogenation and rubber production). Although it is possible to use natural gas liquids as petrochemical feedstock (ca. 2 mt in 2017), its cracking is less effective, which makes it rather a gas processing feedstock (over 80% of the total production) for LPG and naphtha. On top of that, ethane consumption is in line with the production as there is no ethane market in Russia due to lack of the necessary infrastructure.

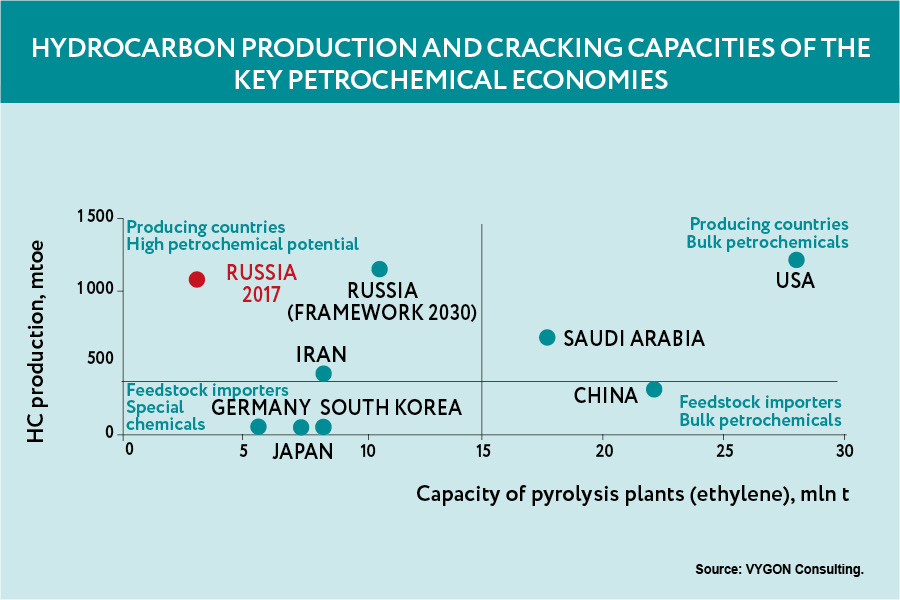

Russia is a leading oil and gas producer, but it accounts for a mere 2% of the global petrochemical output.

Does the significant domestic feedstock oversupply lay the groundwork for petrochemical capacity growth? Out of 23 mt of naphtha exported only 6 mt is suitable for cracking. The remaining 17 mt is heavy and secondary naphtha, which has low olefins yield or is technologically unsuitable for petrochemical processing.

The current 6 mt of LPG exports are already reserved for ZapSibNeftekhim, SIBUR’s new project. Thus, the actual volumes available for petrochemical production are quite low. Ethane could make a solid starting point, with the recovery currently standing at 6–8% of the potential 15 mt. Ethane cracking produces high yield of ethylene but its recovery requires additional investment in deep conversion, and the transportation issues chain ethane chemical facilities to gas fields.

Domestic shortage

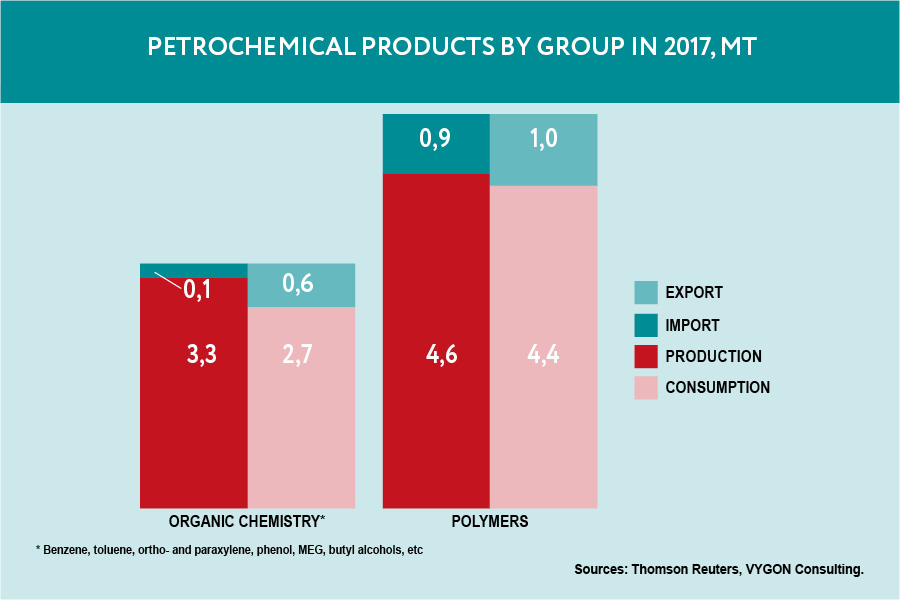

The domestic market is still short of special chemicals and certain types of polymers: in 2017, their imports totalled ca. 1 mt. At the same time, some polymer grades and organic chemistry categories show consistent oversupply and can be exported.

With domestic production 5–8 times below the global leaders’ – China, the USA and Saudi Arabia.

In 2017, ca. 20% of organic chemicals (primarily ortho- and paraxylenes and monoethylene glycol) and bulk polymers (polypropylene, high-/low-pressure polyethylene) was sold on the foreign markets. Imports mostly consist of special fine chemicals and certain polymer grades (e.g. linear low-density polyethylene and emulsion PVC) with insufficient domestic production. Capacity growth opportunities are limited primarily by the lack of technology and shortage of basic monomer production capacity.

Framework 2030

Russia is a leading oil and gas producer, but it accounts for a mere 2% of the global petrochemical output, with domestic production 5–8 times below the global leaders’ – China, the USA and Saudi Arabia.

Developing the petrochemical industry is no easy task – it involves high-tech, complicated market with thousands of products, varying level of feedstock availability, and many other factors. The first comprehensive document to determine the priorities and targets of the petrochemical industry was Oil and Gas Chemical Development Framework through 2030 (Framework 2030) approved in 2012. The strategy provided for six new special conglomerate clusters that would lay the foundation for the development of the petrochemical industry.

According to Framework 2030, the petrochemical output should have reached 7.8 mt by 2017 and 12.8 mt by 2020, beating the capacity of such major producers as Japan, South Korea, and Iran. But the programme went awry – out of eight projects announced, only two are currently under way, two more are on hold, the rest have been cancelled.

Among Framework 2030 projects under way are ZapSibNeftekhim (SIBUR, to be commissioned in 2019) and Nizhnekamskneftekhim (TAIF, first phase to be commissioned in 2022). By 2020, the ethylene petrochemical capacities will grow only by 1.5 mt against the target 9 mt.

In 2017, ca. 20% of organic chemicals (primarily ortho- and paraxylenes and monoethylene glycol) and bulk polymers (polypropylene, high-/low-pressure polyethylene) was sold on the foreign markets.

The delays and failures can be mostly attributed to:

• complicated light feedstock consolidation, partially coming from the lack of infrastructure (ethane and NGL pipelines). For instance, Baltic Petrochemical Plant was cancelled because the pipelines for feedstock supply from the Valanginian deposits of Yamal-Nenets Autonomous Area have not been laid;

• unconfirmed resource base for certain projects. For example, Caspian Gas Chemical Complex was cancelled due to lower fat components in the gas planned for production in the North Caspian fields.

May orders

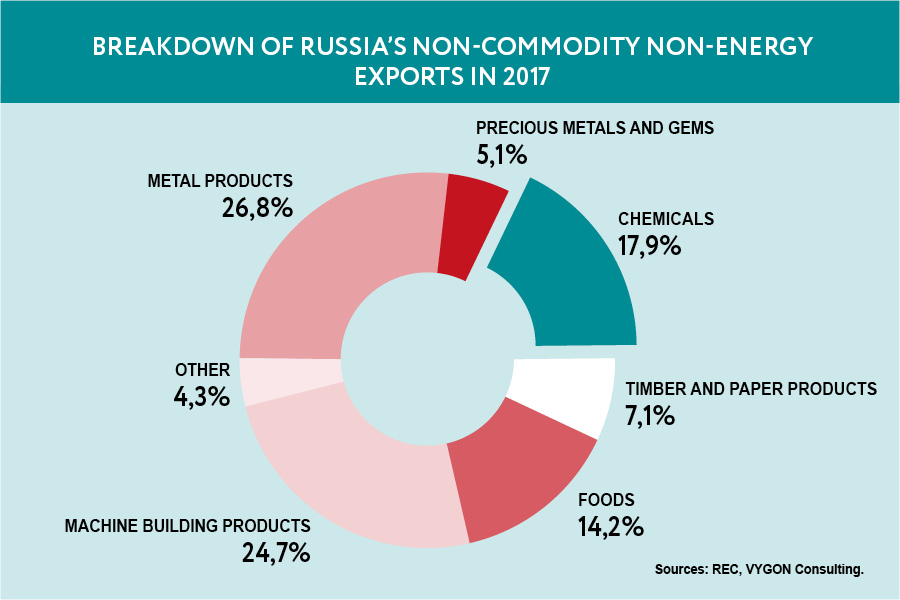

On 7 May 2018, the President signed the executive order On National Goals and Strategic Objectives of the Russian Federation through 2024. One of the targets is non-commodity non-energy export growth to USD 250 bn by 2024. Despite their hydrocarbon origin, petrochemicals are not considered a commodity. So the industry became a focus of attention as a potential pocket of growth. What is its current share in non-commodity exports and how much more can it gain?

In 2017, non-commodity exports hit USD 134 bn, with chemicals accounting for 18%, or USD 24 bn. The share of petrochemicals in that amount is small – ca. 10%, the rest is fertilisers, intermediate chemical products, and pharmaceuticals. Thus, the current share of petrochemicals in Russia's exports is estimated at just 1–2%. But due to limited domestic demand, most large-scale projects will target international markets, so the potential can be quite solid.

Let us take a look at the projects that are likely to come to life over the next 5–7 years. Apart from ZapSibNeftekhim and Nizhnekamskneftekhim already under way, the Framework also includes Amur GCC, to be put into operation in 2024 along with the third stage of Gazprom’s Amur GPP's launch.

Amur Gas Chemical Complex will process valuable cuts from the natural gas produced at Chayandinskoye and Kovyktinskoye fields and supplied through the Power of Siberia. The design capacity will stand at 1.5 mtpa. Another project included in the Framework 2030 is Far Eastern Petrochemical Company. Project details have not been finalised yet – either naphtha or heavier cuts delivered from the eastern refineries of Rosneftcan be cracked, deadline – no earlier than 2026.

On top of the projects in the Framework, there is a new Irkutsk Polymer Plant (IPP). The medium-sized petrochemical facility with 650 mtpa ethylene capacity is being built by Irkutsk Petrochemical Company in Ust-Kut, and will rely on ethane and LPG from the company’s fields. The facility will mostly produce polyethylene of various grades. In addition to the olefin facility, the company plans to build a monoethylene glycol plant so as to potentially become the first plant in Russia to use the MTO (Methanol To Olefins) technology.

Once the companies proved the potential strong effect from new petrochemical capacities, they started to approach the authorities with new support initiatives that could mitigate nvestment risks.

Most complexes will focus on bulk polymers, which means that the domestic market will still face shortage of certain special petrochemicals. Given the moderate consumption growth pace in Russia, the chemicals from the new facilities will be exported to Europe and Asia. If the projects are completed on time and the market conditions are favourable, the petrochemical exports may triple by 2024, growing by USD 3–5 bn. That would stand for 2–4% of the required USD 116 bn non-commodity export growth.

Petrochemical industry support

Once the companies proved the potential strong effect from new petrochemical capacities, they started to approach the authorities with new support initiatives that could mitigate nvestment risks. The main idea is to introduce tax deductions currently applicable to naphtha to LPG and ethane supplied to petrochemical facilities.

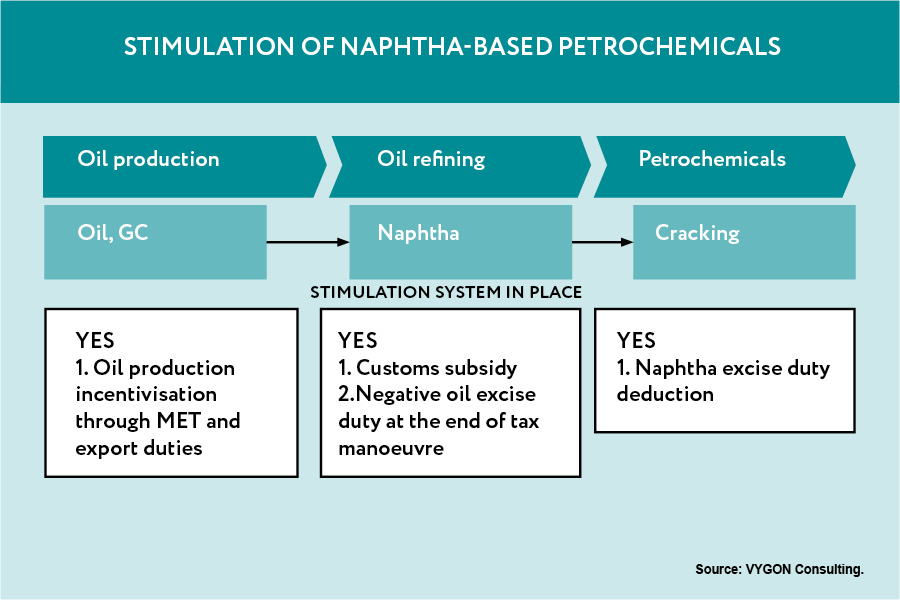

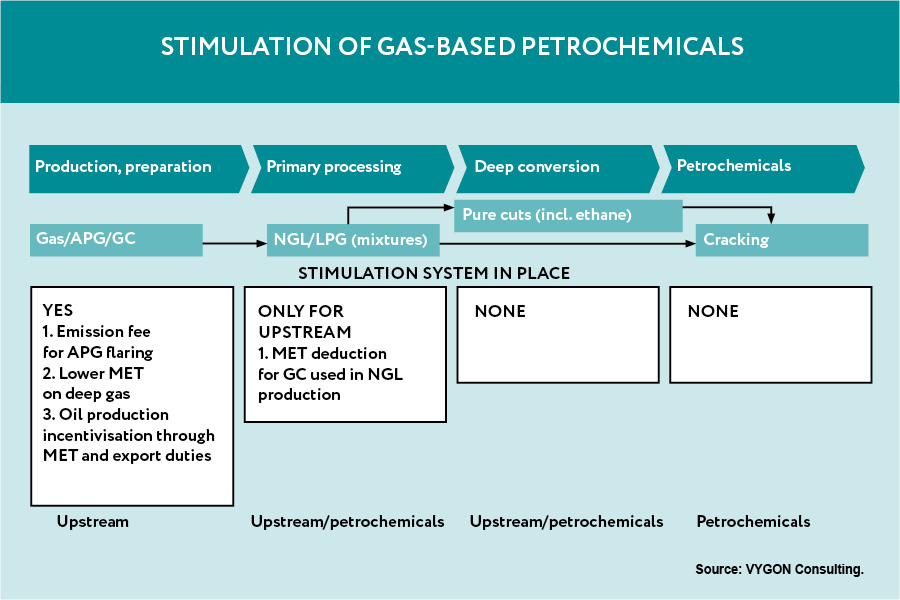

Let us review the existing support framework along the petrochemical value chain. The petrochemical feedstock comes both from oil production (primarily in liquid form – naphtha) and gas production (light feedstock). Historically, all petrochemical regulation system is closely linked to oil industry, and currently all stimulation instruments for petrochemicals are available only for naphtha cracking. They include a customs subsidy to lower naphtha price for domestic consumers and an excise duty deduction available only for petrochemical enterprises.

If we consider the entire chain of liquid feedstock-based petrochemical production, every stage starting from oil production is subsidised. Moreover, naphtha oversupply in Russia stands at ca. 27 mt, as it is produced by over 30 refineries across the country. Only 25–40% of the volume can be used for steam cracking (as secondary naphtha is technologically unsuitable) but it gives a solid foundation for growth.

At the end of the tax manoeuvre, naphtha duties are lifted and the subsidy will consist exclusively of excise duty deduction. By 2024, it will stand at ca. RUB 12.500 per tonne. Notably, the customs duties are replaced with excise at the end of the tax manoeuvre only for the petrochemical industry. For jet fuel, for example, the deduction will remain on the level of 2017–2018. This proves once again the government’s willingness to support the petrochemical industry while maintaining status quo.

As for light feedstock, since oil prices fell in 2014, the LPG duties, and consequently the tax subsidy, were rarely anything other than zero. And currently, Russia has no other instruments to support gas feedstock based (including LPG and ethane) petrochemicals. The state stimulation system has only been developed for the upstream and basic gas processing. The instruments such as MET deduction for NGL or TPBM extraction are unlikely to produce a noticeable effect on the petrochemical projects bottom line, as there is no pricing adjustment mechanism in place and the only the upstream is subsidised.

Until recently, NGL cracking used to be more profitable due to higher yield of target products. Moreover, pure LPG cuts have broader applicability in the production of the same petrochemicals.

The main idea is to introduce tax deductions currently applicable to naphtha to LPG and ethane supplied to petrochemical facilities.

Use of NGLs entails a number of challenges, the main one being lack of infrastructure for preparation and transportation. The lack of midstream business in Russia makes infrastructure development a burning issue. Oil and gas companies can sell primary processing products or not distinguish petrochemical feedstock at all.

On the other hand, petrochemical projects are highly capital-intensive and might not be able to shoulder the additional expenses of building the infrastructure. Out of 25 mt of propane-butane cuts extracted, only 17–18 mt become a marketable product.

Ethane, the highest-yield petrochemical feedstock, poses even more challenges. On top of the complicated and expensive extraction process, it is not considered a marketable commodity in Russia. Therefore, the infrastructure issues are further aggravated by pricing uncertainty.

Currently, petrochemical companies have moderate bargaining power due to very limited number of feedstock sources. High investment requirements and EBITDA in absolute terms way below revenues from the core business make petrochemicals and deep conversion far from being the strategic focus of most gas companies.

In most cases, ethane-based petrochemical facilities can be considered only as a part of an integrated gas project, which may currently be a negative business case mainly due to hefty investments in deep conversion and petrochemicals.

Potential solutions

Companies use the petrochemical case to back their proposals to unify tax treatment of different feedstock. One of these was to introduce negative excise tax on LPG and ethane to balance the petrochemical feedstock prices and factor in the value of the by-products.

According to Framework 2030, the petrochemical output should have reached 7.8 mt by 2017 and 12.8 mt by 2020.

For LPG-based petrochemicals, the application of this instrument is clear. LPG is a marketable commodity, and, as in the naphtha case, in the export parity pricing model, the excise tax deduction will decrease the feedstock prices. The remaining question is whether LPG excise tax will affect other consumer industries (gas engine fuel, utilities and consumer services). If necessary, reasonable offset mechanisms can be developed. The subsidy in this case will have to stand at ca. RUB 9,000 per tonne of LPG.

For off-market ethane, it is not even clear who will receive the subsidy. The current and prospective ethane cracking facilities are tied to gas fields and gas processing infrastructure, and the feedstock price is decided on case-by-case basis.

In case of a subsidy, the party with better bargaining position can adjust the price accordingly. Thus, pricing remains a key question and low interest from the upstream companies in developing chemical production can rip the initiative to shreds.

What about off-the-shelf solutions?

Is creating new tools to subsidise gas-based petrochemical production the only option? Is it true that in today’s Russia petrochemical companies have no adequate support to develop their business?

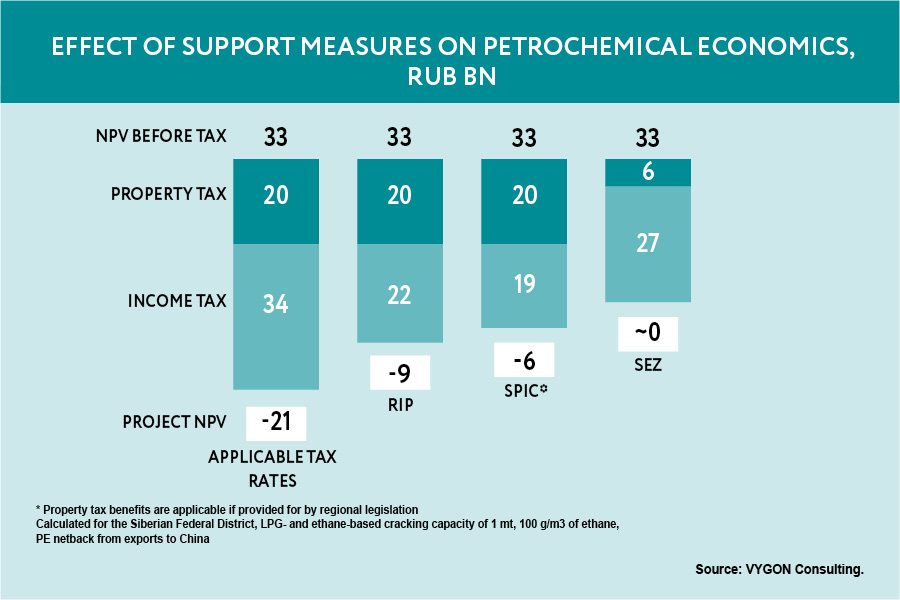

Petrochemical projects are primarily associated with high capital intensity and margins. At the same time, with no special tax treatment in place for the petrochemical industry (e.g. duties and excise taxes), income and property tax payments make up the bulk of their contributions to the budget. The government has introduced a number of support measures for major investment projects.

In 2017, non-commodity exports hit USD 134 bn, with chemicals accounting for 18%, or USD 24 bn.

Their key advantages are:

• PSEDA, RIP, SEZ, SPIC and similar initiatives are already in place;

• they cover the bulk of tax payments;

• the government can make sure subsidies do not exceed potential budget revenues.

While these measures could potentially improve petrochemical project economics, it remains unclear whether the industry will be able to use them.

Priority Social and Economic Development Area (PSEDA). Targeting regions’ social and economic development through benefits to the anchor investor, the measure focuses on creating a diversified industry mix in monotowns.

The legislation provides for establishing PSEDAs outside Far-Eastern monotowns and their further advancement across Russia. Since kick off in 2014, PSEDAs increasingly gained traction as a way to bolster production in far off areas, with Neftekhimichesky (anchor investor – Eastern Petrochemical Company) and Svobodny (Amur GPP and Amur GCC as a potential resident) PSEDAs emerging in the meantime. Later on, the government opted not to set up PSEDAs outside monotowns.

Special economic zone (SEZ). Very similar to PSEDA, SEZ became the first measure introduced in 2005 to accelerate the development of priority industries. Before mid-2018, there was a moratorium on new SEZes, which is currently removed. Alabuga is among successful SEZes, including in the chemical industry.

Regional investment projects (RIP). The measure seeks to provide targeted support to regional capital-intensive projects. Unfortunately, income tax benefits that could significantly improve the economics of high-margin petrochemical projects, will expire in 2028. This means no contemplated petrochemical project will be able to fully benefit from the subsidies. Special investment contract (SPIC) Like RIP, SPIC is a form of a public-private partnership in Russia to boost local industrial production. While similarly offering income, property, land and transportation tax benefits, SPIC also secures that these are fixed, which gives it an advantage over other support measures.

The government is getting ready to release a set of legislative amendments dubbed SPIC 2.0 (available on the Ministry of Finance's website), which are currently at the stage of regulatory impact analysis. Under the new law, tax benefits will be available throughout the contract term. Additionally, it raises a minimum investment requirement to RUB 1 bn and makes it possible for several investors to participate. On top of that, SPIC 2.0 offers broader support, including budget (subsidies, guaranteed public contracts for products made under SPIC 2.0, investments in management companies), pricing (regulated prices) and infrastructure (special grid connection terms and tariffs) incentives.

This by now is far from being an exhaustive list of measures that could work for the petrochemical industry, but would also involve certain limitations (moratoriums, inadequate regional legislation, more red tape).

Time to act

It is beyond any doubt that the petrochemical industry needs support, but it takes a lot of time and effort to create a full range of incentives. In the leading petrochemicals-producing countries, the government took an active part in the process by building infrastructure for new clusters and supplying feedstock, in addition to offering benefits and subsidies.

Companies use the petrochemical case to back their proposals to unify tax treatment of different feedstock.

To adopt global best practices for tax incentives, Russia would have to drastically change its taxation system. Unlike Saudi Arabia, Russian oil and gas producers that could facilitate their implementation are joint-stock companies and, therefore, cannot take part in loss-making projects. Then, there are MLPs (Master Limited Partnerships), a form of a publicly traded limited partnership that combines tax benefits and a unique governance structure. MLPs pay no income tax, with nearly all profits distributed to investors instead, which boosts their returns in the most capital-intensive (mostly infrastructure) projects. This form of partnership popular in the US will be hard to implement in Russia due to its still immature stock market.

For the petrochemical industry to advance, the government needs to come up with a set of targeted support measures, which would also address its strategic goals (increase in non-commodity exports, new jobs, more tax revenues, etc.). Whatever measure is selected as dominant, the government needs to guarantee its reliability and stability in the long term.

Dmitry Akishin, Head of Gas and Chemistry at VYGON Consulting

Eugene Tyrtov, analyst at VYGON Consulting

Source: Oil&Gas Journal Russia

Download PDF