Recycling is one of the most pressing topics making headlines today. Its development is equally supported by the government and people who are willing to participate in separate waste collection. In an interview to SIBUR for Clients, Konstantin Rzaev, CEO of EcoTechnologies, discusses why the industry is in crisis despite this favourable background and what is in store for recycling in Russia.

It has been almost a year since the waste management reform was enacted in Russia. What do you think of its results?

As recycling companies fought to become regional operators and relied on inaccurate waste generation estimates for the regions, they came up with unreasonably low tariffs which have ultimately failed. In addition, households have been reluctant to pay for the full cost of waste removal and storage. As a result, regional operators who were handed over the reigns of the industry for many years to come are now having turbulent times. At the onset, their first priority – apart fr om waste collection from households and commercial customers – was to invest in modern landfills and waste sorting facilities. However, at this point we see many of them struggle with losses, hardly able to fund their operating costs, let alone investments. I would think of it as the biggest problem and disappointment in the Russian recycling industry in 2019.

Double bin for separate waste collection.

The Russian government acknowledges waste recycling as a national priority. In 2018, it approved a strategy to develop pre- and post-consumer waste treatment, disposal and decontamination capacities by 2030. In 2019, Russia has launched a waste management reform, which entails the development and approval of regional waste management plans, designation of regional operators responsible for the entire waste management cycle in their regions, setting of regional waste management tariffs, construction of advanced waste management facilities and much more. The reform aims to promote the "three Rs" of sustainability – reduce, reuse and recycle – widely implemented across the developed markets, with around RUB 5 tn committed to this cause over the next 14 years.

Wire mesh recycling cages installed across Russia.

The key problem, by and large, is the lack of sorting capacities. In 2016–2018, recycling companies expected a surge in recyclables collection driven by the reform.

How has the reform affected PET recycling in Russia?

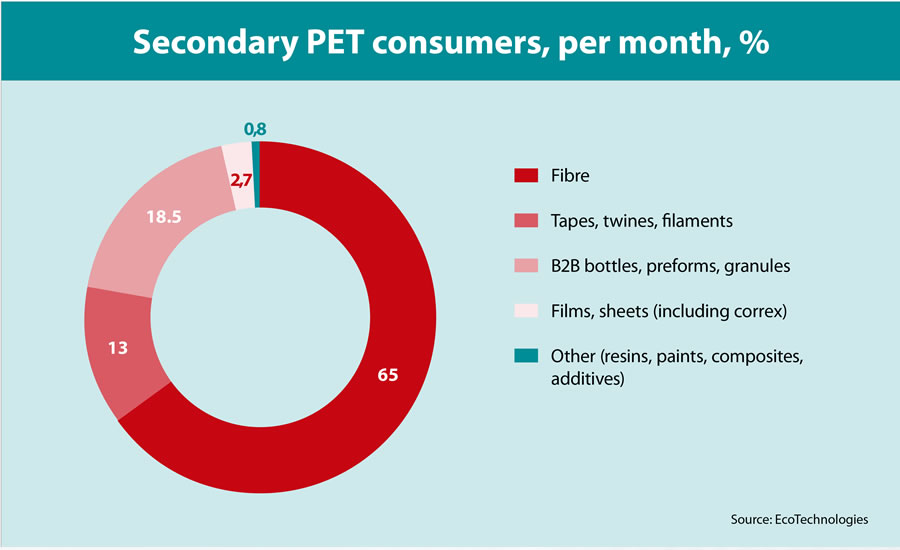

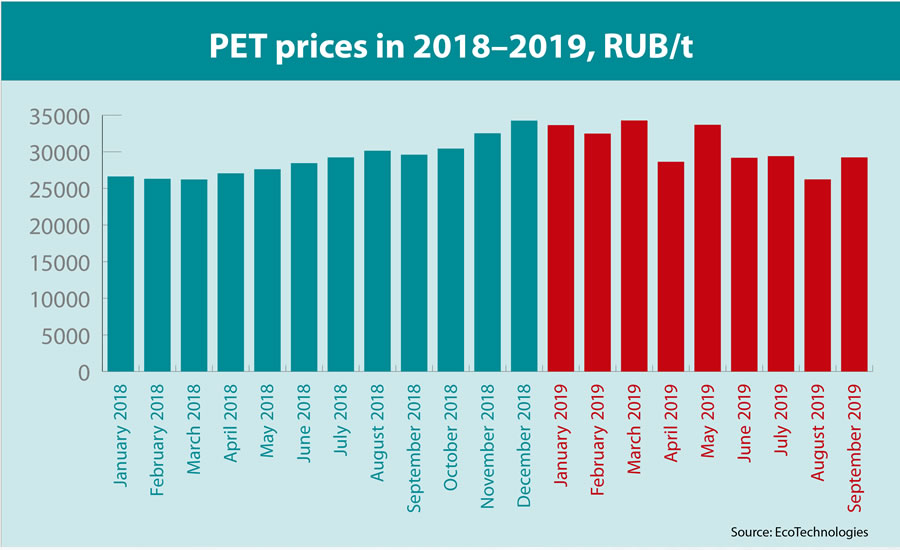

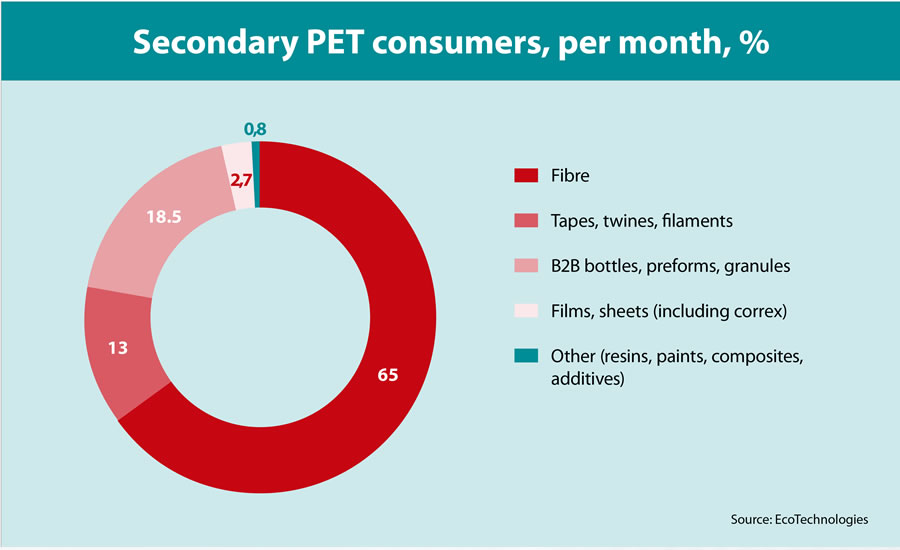

Less than 7% of all solid waste is being sorted in Russia. Polyethylene terephthalate (PET) is the most collected and recycled type of waste, with 24–26% of all produced PET being recycled. The key problem, by and large, is the lack of sorting capacities. In 2016–2018, as recycling companies expected a surge in recyclables collection driven by the reform, many of them invested into capacity expansion and new facilities for the production of polyester fibres, PET sheets and preforms, which has ensured sufficient market demand for recyclables. However, due to their financial troubles, regional operators failed to launch their long-awaited waste sorting facilities. Many of their projects were suspended, while others simply fell short of approval. So, there is still a critical shortage of recyclable materials in the market and we have seen it very clearly in the first half of the year. In May, this resulted in recycled PET prices hitting a record high of RUB 40,000–42,000 per tonne.

The demand for recycled PET is still growing. The world's largest producers of packaged goods, including such trend-setters like Coca-Cola, Danone and Unilever, have announced an ambitious goal to make all their consumer packaging 100% recyclable and to have 50% recycled content in their packaging by 2030.

Coca-Cola presented the world's first bottle made with recycled marine plastic. Photo: www.telegraph.co.uk.

How do you expect this situation to play out going forward?

With prevailing environmental trends and the focus on recyclable packaging among major consumers, we will see growing demand for recycled PET. Whether this demand will be met will depend on how regional operators – who are in charge of building and operating waste sorting capacities – will get out of the crisis.

While the development of waste recycling infrastructure is in full swing in Russia, there is an insufficient supply of recyclables, even though Russia has vast amounts of plastic waste: according to Russian Greenpeace office, the country generates some 3 million tonnes of plastic waste annually, with only 12% of it being recycled. At the same time, experts say that the lack of supply has boosted prices for recycled plastic by almost 20% in recent years, narrowing the price gap between primary and secondary plastic. Now, the gap has fallen to 10–20% only, according to a Russian recycling company Slavplastik.

The world's largest producers of packaged goods have announced an ambitious goal to make all their consumer packaging 100% recyclable.

What are the barriers to separate waste collection in Russia?

Most of them are linked to the lack of pro-environmental mentality. Fortunately, this is fixable as eight out of ten Russians are willing to sort waste. However, the required infrastructure would not appear without specific steps and financial investments. For example, one wire mesh recycling cage costs some RUB 10,000 and they need to be installed at each and every container site across the country, with their total number being as high as hundreds of thousands. The lack of money in the industry and in the regional operators' budgets in particular hinders the process. The second problem is low awareness and we need a nation-wide campaign to boost it. The third one is the lack of financial incentives for people to sort waste. All these barriers are not insurmountable and can be removed.

What steps by the government and the private sector are needed to scale up plastic waste recycling?

A substantial part of plastic packaging waste cannot be recycled – either at all or in a cost efficient manner. For instance, this is true for multi-layer packaging made up of various types of polymers, such as PET and polypropylene. But still, it can be used to manufacture useful products, including wood-plastic composites or polymeric sand products, to make benches, tiles, parking bumpers, and other items to improve urban infrastructure. However, the market for such products is rather limited today, so a law on green public procurement would come in handy to boost the use of recycled materials and recycled plastics in particular. I know that it is being debated a lot and the decision has not yet been made, so we keep fingers crossed.

Recycled plastic park bench.

Just look at the Netherlands for an example of how a government can support the use of recycled tyres and other waste in road construction in the country. If similar decisions were made in Russia, this would help make use of a great amount of mixed and other problematic plastic waste.

Do you think the production of raw materials from recycled plastic to be a promising area?

If done right, it can benefit the government, the industry, and the economy. However, from the macroeconomic perspective, there are few cases in history when someone grew rich from recycling. The profitability mainly hinges on the economies of scale: there is no reason for large-scale recycling facilities if there is little waste. In this case, companies are not only unprofitable, but lose money. However, if you take a strategic approach and engage in recycling on a large scale, it can turn into a lucrative business.

With prevailing environmental trends and the focus on recyclable packaging among major consumers, we will see growing demand for recycled PET.

What can you say about the current demand for secondary raw materials in Russia?

Undoubtedly, it is in demand because of its lower price. There is a great deal of scepticism about its quality though, while in those countries wh ere recycling is up and running (China, Europe and North America) the situation is reversed. These countries are switching to recycled materials only to produce garden furniture, pipes, or decking, and in Europe it is difficult to find a manufacturer that would use primary raw material at all. In other words, this is an established practice in many countries, requiring advanced and expensive equipment, however, which is unprofitable for a small company. A large-scale production in Russia would not have enough raw materials so far.

PET is the most collected and recycled type of waste.

Who do you think among domestic manufacturers is the most interested in recycled materials?

I think these are primarily the construction and packaging industries, manufacturers of various vehicle wraps, shrinkable, and pallet wrap films, and bin bags. Some types of recycled materials are not appropriate for the packaging industry, as products come into direct contact with the packaging material. Still, there are many materials that can and should be reused, with PET as a bright example: Unilever and Coca-Cola already use from 30% to 100% of recycled polymers for the packaging of some of their brands. The demand for recycled materials is high, but much relies on how quickly domestic processors will be able to achieve the desired quality.

Feedstock costs and demand make the market for recycled plastics attractive to processing companies. However, the lack of a well-oiled system for polymer waste collection hinders recovery rate. According to Anna Volkova, leading analyst of the HSE Centre of Development Institute, ferrous and non-ferrous metal scrap is the most recycled material, followed by paper waste, with an overall recovery rate of 27% (meaning some 3 mt of raw material can be recycled out of 12 mt), glass, and, in lastly, plastic, with a recovery rate of as little as 10–15%. This is driven by the fact that 60% of plastic waste comes from the residential sector, whereas recycling is industrial waste is much easier.

If you take a strategic approach and engage in recycling on a large scale, it can turn into a lucrative business.

What policy is currently in place for import and export of secondary raw materials and what are the key drivers?

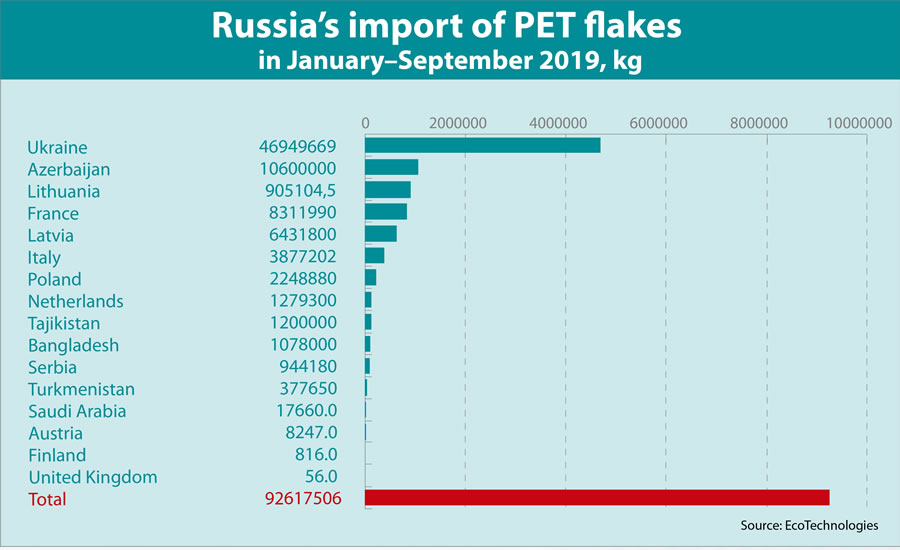

There are certain restrictions on paper waste and scrap metal, yet there are none on plastics. I think that in this respect, we should be fully integrated into the global community. In Russia, there is no severe shortage of feedstock or recycled materials, rather, we lack waste because it is not appropriately sorted. We should have the opportunity to import raw materials, and it would be great to have something to export as well.

Given the shortage of domestic resources, it would be unfair to recyclers to create extra barriers. They do not have enough, anyway. In this case, people who have invested time, money in the recycling business, and pinned their hopes on it, may go bankrupt and just quit. This may have an irreversible impact on society and shape a negative attitude towards the processing industry for many years to come, hampering its development.

According to the Russian customs, plastic waste worth of USD 20.3 m was imported in 2018, up 32% year-on-year. In the first half of this year, the import of plastic waste increased by 41% year-on-year, with mainly pressed PET bottles as well as PET flakes and polyethylene regranulate being imported.

PET flakes.

A law on green public procurement would come in handy to boost the use of recycled materials and recycled plastics in particular.

What can you recommend to companies that embark on separate waste collection? What do they need to pay attention to, what nuances should be taken into account?

First of all, they should do it anyway. Second, it is necessary to combine infrastructural and educational components: install containers for separate waste collection and raise awareness of people, including on billboards. One thing will not work without the other. Third, start simple: deal with plastic vials or PET bottles, clear films and cardboard. Once you get used to it, you can switch to a more sophisticated separate collection. Be sure that the organisation in charge of the process does not derail the efforts you made, does not mix all waste, but supplies it to professional recyclers.

This is a very touchy subject. Many people really doubt that plastic reaches processing companies. How can it be checked?

In 90% of cases, waste is delivered to its destination. Separate collection takes a lot of effort, while collected factions are in great demand and expensive. However, there are some cases, when waste is separated for the sake of separation to meet certain obligations. Sometimes, cleaning services fail to collect enough waste to make it attractive for recyclers.

Experts believe that weak regulatory oversight is one of the reasons behind the disappointing results of the new reform. “Waste management agreements are concluded by business entities, and this area is not yet sufficiently regulated,” says Elena Vishnyakova, Deputy CEO of Ecoline, the company that collects and sorts municipal solid waste. “Still, there are cases of waste ending up in the nearest ditch. People believe that paying less means that they are not responsible. That is why we face numerous scandals when waste is burnt within the city. I think that it is highly important to adopt a relevant law, introducing fines for inappropriate waste handling.”

Could you tell us about your cooperation with SIBUR?

We are happy to see that SIBUR, the undisputed leader in its segment, makes sure that products made of its materials are recyclable. Now, it has become trendy to declare sustainable development goals, but when it comes to reality, not all companies are ready to take action. SIBUR has shown its commitment, promoting the use of plastic at public events, supporting social initiatives, and establishing an R&D centre in Skolkovo. These are all real actions that require financial and organisational investment and seek to increase awareness. It is also very important that SIBUR, unlike other producers of polymeric feedstock, is cooperative: ready to partner, receive feedback and respond to recyclers, take its consumers' needs seriously.

Containers for separate waste collection at Tomskneftekhim.

What can we expect in the Russian PET recycling market in 2020?

On the one hand, we will see an increasing demand for high-quality recycled plastic. As for regional operators, the problems will persist, unless the government wishes to support the industry financially, which is highly unlikely. The shortage of recycled materials will continue. We believe that consumers will become more eco-friendly and more interested in recyclability, potentially fostering the creation of new production projects, while manufacturers, packagers and recyclers will join forces to agree on and address the sustainability agenda.

Download PDF

Konstantin Rzaev

CEO of EcoTechnologies